Dehner corporation uses a job-order costing system – Dehner Corporation’s adoption of a job-order costing system stands as a testament to the effectiveness of this approach in managing production costs. This system enables Dehner to meticulously track and assign costs to specific job orders, ensuring precise cost accounting for each unique product manufactured.

The implementation of a job-order costing system at Dehner Corporation has revolutionized their cost tracking capabilities. This system provides a detailed breakdown of costs incurred during the production process, allowing for informed decision-making and optimized resource allocation.

Overview of Dehner Corporation’s Job-Order Costing System

Dehner Corporation uses a job-order costing system to track costs for its products. A job-order costing system is a method of costing that accumulates costs for each individual job or batch of production. This system is typically used in industries where products are produced in small batches or on a custom basis, such as in the furniture or construction industries.

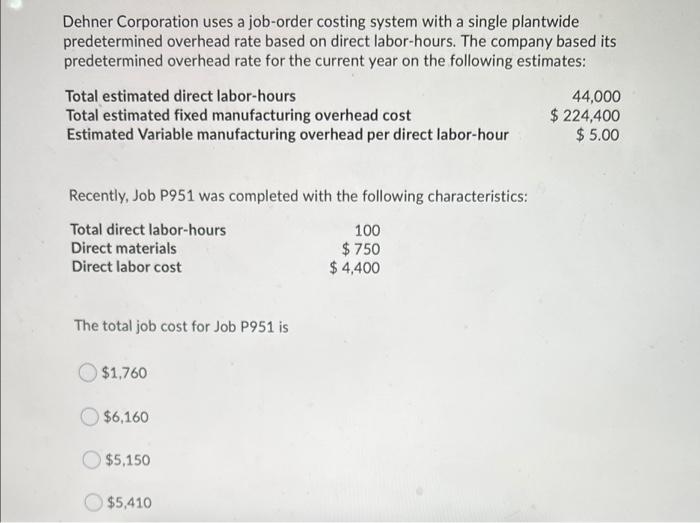

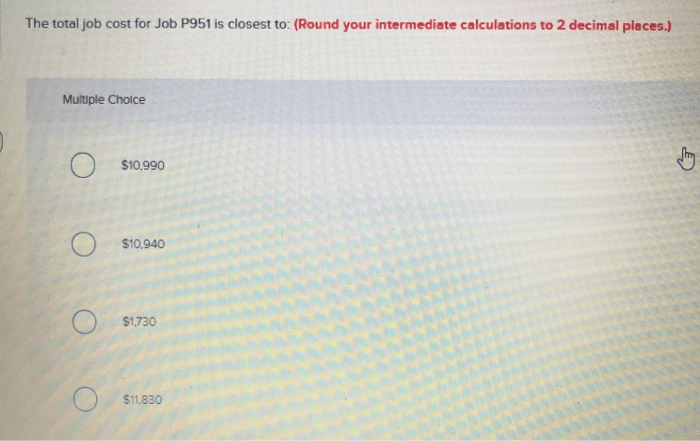

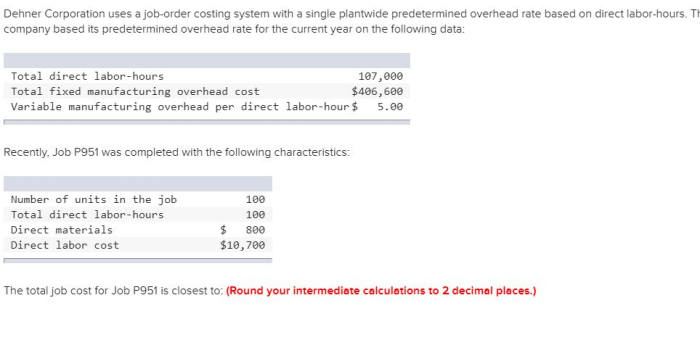

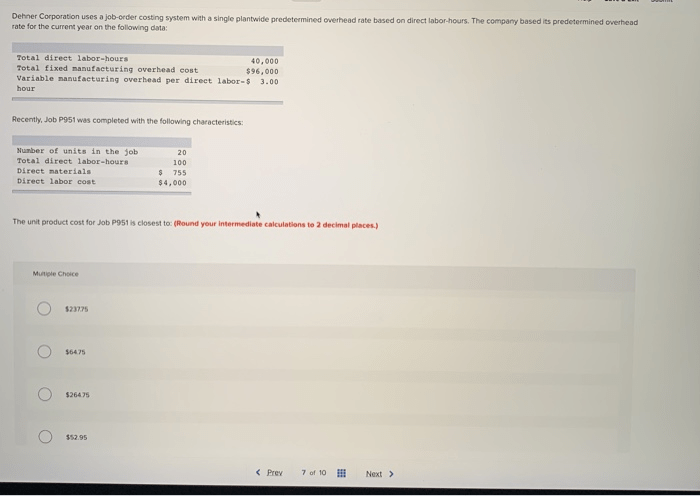

Dehner Corporation’s job-order costing system tracks the costs of direct materials, direct labor, and manufacturing overhead. Direct materials are the raw materials that are used to create the product. Direct labor is the labor that is directly involved in the production of the product.

Manufacturing overhead is the indirect costs of production, such as rent, utilities, and depreciation on equipment.

Key Elements of Dehner Corporation’s Job-Order Costing System

Direct Materials

Dehner Corporation uses a variety of direct materials in its production process, including wood, fabric, and hardware. The cost of direct materials is tracked on a per-job basis. When direct materials are purchased, they are assigned to a specific job order.

Direct Labor

Dehner Corporation’s direct labor costs include the wages and benefits paid to production workers. The cost of direct labor is also tracked on a per-job basis. When production workers work on a specific job order, their time is charged to that job order.

Manufacturing Overhead

Dehner Corporation’s manufacturing overhead costs include rent, utilities, and depreciation on equipment. These costs are not directly related to any specific job order. Instead, they are allocated to job orders based on a predetermined overhead rate.

Job Cost Sheet

Dehner Corporation uses a job cost sheet to track costs for each job order. The job cost sheet includes the following information:

- Job order number

- Product description

- Quantity

- Direct materials

- Direct labor

- Manufacturing overhead

- Total job cost

The job cost sheet is used to track the costs of a job order throughout the production process. The total job cost is used to determine the selling price of the product.

Advantages and Disadvantages of Dehner Corporation’s Job-Order Costing System

Advantages, Dehner corporation uses a job-order costing system

- Provides detailed cost information for each job order

- Helps to identify areas where costs can be reduced

- Supports decision-making by providing information about the profitability of each job order

Disadvantages

- Can be more expensive to implement and maintain than other costing systems

- Can be difficult to track costs accurately when multiple jobs are being worked on simultaneously

- May not be suitable for companies that produce high volumes of standardized products

Alternative Costing Systems: Dehner Corporation Uses A Job-order Costing System

In addition to job-order costing, there are other costing systems that Dehner Corporation could consider using. These systems include process costing and activity-based costing.

Process costing is a method of costing that accumulates costs for each process or department in the production process. This system is typically used in industries where products are produced in a continuous flow, such as in the food or chemical industries.

Activity-based costing is a method of costing that assigns costs to products based on the activities that are performed to produce them. This system is typically used in industries where there is a high degree of diversity in the products that are produced, such as in the electronics or software industries.

The choice of which costing system to use depends on a number of factors, including the nature of the production process, the volume of products produced, and the diversity of products produced.

FAQ Explained

What are the key advantages of using a job-order costing system?

Job-order costing systems provide detailed cost information for specific job orders, allowing for accurate product costing and informed decision-making.

How does Dehner Corporation accumulate and assign costs to job orders?

Dehner accumulates costs for direct materials, direct labor, and manufacturing overhead, and assigns them to specific job orders based on actual usage or predetermined rates.

What are the potential limitations of a job-order costing system?

Job-order costing can be complex and time-consuming, especially for companies with high-volume production or a diverse product mix.