Consider the following incomplete deposit ticket: it’s a common occurrence that can lead to significant operational challenges for banks. This article delves into the causes, consequences, and best practices associated with incomplete deposit tickets, providing valuable insights for financial institutions and their customers.

Incomplete deposit tickets can result from various factors, including human error, system malfunctions, and external factors. They can cause delays, errors, and security risks, impacting bank operations and customer satisfaction. To mitigate these challenges, banks should implement robust procedures for handling incomplete deposit tickets, including clear communication channels, established timeframes, and comprehensive training programs.

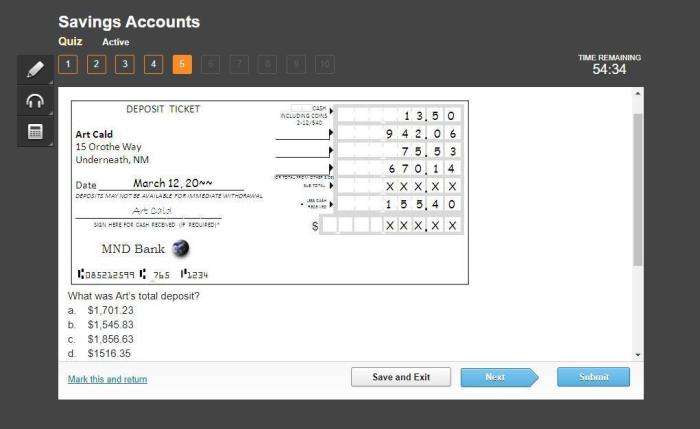

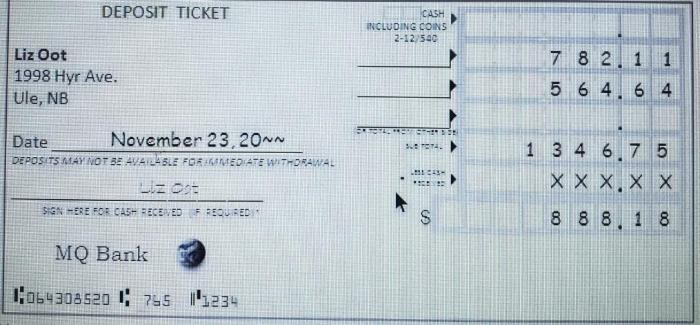

Incomplete Deposit Ticket Identification: Consider The Following Incomplete Deposit Ticket

An incomplete deposit ticket lacks essential information necessary for proper processing. Common missing or incomplete information includes:

- Account number

- Amount deposited

- Depositor’s name and address

- Date of deposit

- Signature

Incomplete deposit tickets can delay processing, cause errors, and pose security risks.

Causes of Incomplete Deposit Tickets

Incomplete deposit tickets may result from:

- Human errors (e.g., oversight, illegible handwriting)

- System malfunctions (e.g., software glitches, printer issues)

- External factors (e.g., inclement weather, power outages)

Incomplete deposit tickets can disrupt bank operations and create inefficiencies.

Procedures for Handling Incomplete Deposit Tickets

Incomplete deposit tickets are processed as follows:

- Identified and flagged for review

- Communication with depositor to request missing information (e.g., phone, email)

- Temporary hold placed on deposit until information is provided

- Deposit processed upon receipt of complete information

Timeframes and protocols vary depending on bank policies and the extent of missing information.

Prevention of Incomplete Deposit Tickets, Consider the following incomplete deposit ticket

Strategies to minimize incomplete deposit tickets include:

- Providing clear instructions and training to staff and customers

- Creating a deposit ticket checklist or template

- Implementing automated verification systems

- Regularly reviewing and updating deposit ticket procedures

Preventive measures reduce the risk of incomplete deposits and improve operational efficiency.

Impact on Bank Operations

Incomplete deposit tickets pose operational challenges, including:

- Delays in processing

- Increased risk of errors

- Potential for fraud

- Reputational damage

Incomplete deposit tickets can also lead to financial losses and impact customer satisfaction.

Case Studies and Examples

Case Study 1:A customer deposited a check for $10,000 but omitted the account number on the deposit ticket. The bank contacted the customer to obtain the missing information, resulting in a two-day delay in processing the deposit.

Case Study 2:A power outage caused a bank’s system to malfunction, resulting in several incomplete deposit tickets. The bank implemented a manual processing system to mitigate the impact and processed the deposits within 24 hours.

Best Practices for Deposit Ticket Management

Best practices for deposit ticket management include:

- Establishing clear and consistent procedures

- Training staff on proper deposit ticket completion

- Implementing automated verification systems

- Regularly reviewing and updating procedures

- Maintaining accurate documentation and records

By following best practices, banks can improve the accuracy and efficiency of deposit ticket processing.

Helpful Answers

What are the most common causes of incomplete deposit tickets?

Incomplete deposit tickets can result from human error, system malfunctions, or external factors such as damaged or missing documents.

What are the potential consequences of submitting an incomplete deposit ticket?

Incomplete deposit tickets can lead to delays, errors, and security risks, impacting bank operations and customer satisfaction.

What are the best practices for handling incomplete deposit tickets?

Banks should implement clear communication channels, establish timeframes for resolving incomplete deposits, and provide comprehensive training programs for staff and customers.