Del gato clinic bank reconciliation – Welcome to the definitive guide on bank reconciliation for healthcare providers, with a focus on the intricacies of Del Gato Clinic’s financial processes. This comprehensive resource delves into the unique challenges and considerations of bank reconciliation in a healthcare setting, providing invaluable insights and best practices to ensure accuracy and efficiency.

As we navigate the complexities of patient payments, insurance reimbursements, and other healthcare-related transactions, we’ll uncover the secrets to timely and accurate bank reconciliation. Join us on this journey of financial clarity, empowering you to streamline your processes and maintain impeccable financial records.

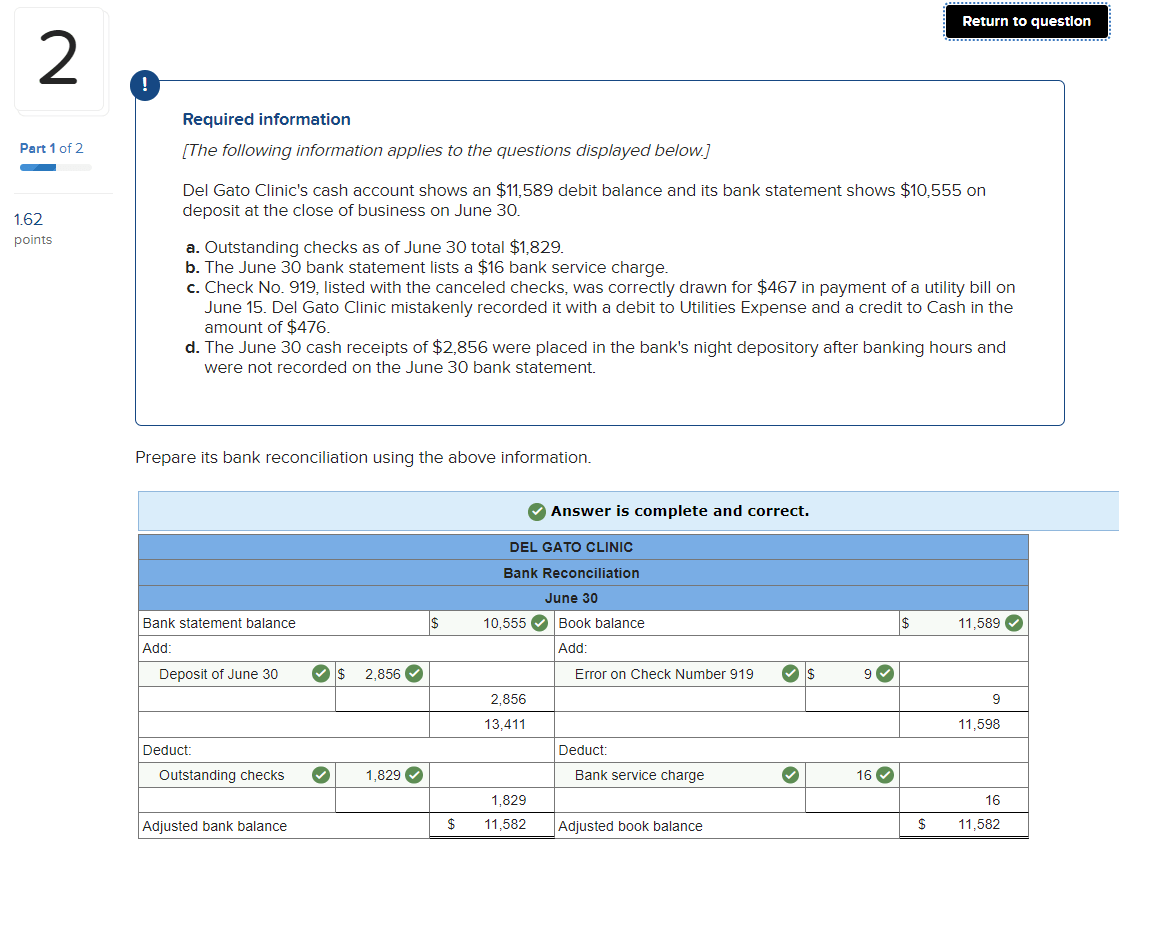

Bank Reconciliation Overview: Del Gato Clinic Bank Reconciliation

Bank reconciliation is a crucial process that ensures the accuracy of an organization’s financial records by matching its accounting records with its bank statements.

This process involves identifying and resolving discrepancies between the two sets of records, ensuring that the organization’s financial statements accurately reflect its cash position.

Steps Involved in Bank Reconciliation, Del gato clinic bank reconciliation

- Compare the ending bank balance on the bank statement with the corresponding figure in the organization’s accounting records.

- Identify any outstanding checks (checks written by the organization but not yet presented to the bank for payment).

- Identify any deposits in transit (deposits made by the organization but not yet reflected on the bank statement).

- Analyze any other reconciling items, such as bank service charges or interest earned.

- Adjust the accounting records and the bank statement to reconcile the two sets of records.

Specific Considerations for Del Gato Clinic

Bank reconciliation in a healthcare setting presents unique challenges due to the complexities of patient payments, insurance reimbursements, and other healthcare-related transactions. Understanding these considerations is crucial for accurate and efficient bank reconciliation.

Patient Payments

Patient payments can be made in various forms, including cash, checks, credit cards, and electronic payments. Each method of payment has its own processing time and potential for errors. Reconciling patient payments requires careful attention to detail and a clear understanding of the clinic’s payment policies.

Insurance Reimbursements

Insurance reimbursements are a significant source of revenue for healthcare providers. However, they can also be complex and time-consuming to reconcile. Insurance companies have their own billing and payment processes, which can vary from one insurer to another. Reconciling insurance reimbursements requires a thorough understanding of the clinic’s contracts with each insurer and the ability to track payments accurately.

Other Healthcare-Related Transactions

In addition to patient payments and insurance reimbursements, healthcare providers may also have other healthcare-related transactions that need to be reconciled, such as:

- Vendor payments for supplies and equipment

- Payroll expenses

- Professional fees

- Grants and donations

These transactions can have varying levels of complexity and require different reconciliation procedures.

Best Practices for Bank Reconciliation

Timely and accurate bank reconciliation is crucial for maintaining the integrity of financial records. Here are some best practices to ensure efficiency and reliability in the process:

Importance of Documentation and Supporting Evidence

- Maintain clear and organized records of all transactions, including supporting documentation such as invoices, receipts, and bank statements.

- Document any adjustments or corrections made during reconciliation, with proper authorization and explanation.

Leveraging Technology

- Consider using accounting software or specialized bank reconciliation tools to automate and streamline the process.

- Set up automated alerts or notifications for unusual or large transactions, reducing the risk of errors or fraud.

Common Errors and Troubleshooting

Bank reconciliation is a critical process to ensure the accuracy of financial records. However, errors can occur during this process. Identifying and resolving these errors promptly is crucial to maintain the integrity of the reconciliation.

Common errors that may arise during bank reconciliation include:

- Unreconciled Transactions:Failure to match all transactions between the bank statement and the company’s records.

- Incorrect Balance:The reconciled balance does not match the actual balance on the bank statement or the company’s records.

- Duplicate Transactions:The same transaction is recorded multiple times in the reconciliation.

- Missing Transactions:A transaction recorded on the bank statement or the company’s records is not included in the reconciliation.

- Posting Errors:Errors in recording transactions in the company’s accounting system.

Troubleshooting Errors

To troubleshoot errors during bank reconciliation, the following steps can be taken:

- Review the reconciliation carefully:Check for any obvious errors, such as incorrect amounts or missing transactions.

- Reconcile the transactions individually:Go through each transaction and verify that it is recorded accurately in both the bank statement and the company’s records.

- Check for duplicate or missing transactions:Examine the transactions in both records to identify any duplicates or missing entries.

- Review the posting process:Ensure that transactions are posted correctly in the accounting system.

- Contact the bank:If the error cannot be resolved internally, contact the bank to verify the transactions.

Importance of Regular Reviews and Audits

Regular reviews and audits of the bank reconciliation process are essential to ensure accuracy and prevent errors from going unnoticed. These reviews can identify potential errors, such as:

- Unreconciled transactions

- Incorrect balances

- Duplicate or missing transactions

- Posting errors

By conducting regular reviews and audits, organizations can proactively address errors and maintain the integrity of their financial records.

Reporting and Analysis

Bank reconciliation is not merely a process of balancing accounts but also a valuable source of information for monitoring and improving financial operations. By analyzing bank reconciliation results, businesses can gain insights into their cash flow, identify areas for improvement, and prevent potential errors.

Reports and Metrics for Bank Reconciliation

Regularly generating reports based on bank reconciliation data can provide valuable insights into a business’s financial performance. Key reports include:

- Bank Reconciliation Report:Summarizes the differences between the bank statement and the company’s records, highlighting any discrepancies that need attention.

- Outstanding Checks Report:Lists all checks that have been issued but not yet cleared by the bank, helping businesses track their cash flow and prevent fraud.

- Deposits in Transit Report:Details deposits made by the business that have not yet been recorded by the bank, ensuring accurate cash flow tracking.

Additionally, businesses can monitor specific metrics related to bank reconciliation, such as:

- Days Sales Outstanding (DSO):Measures the average number of days it takes for customers to pay their invoices, providing insights into accounts receivable management.

- Bank Reconciliation Time:Tracks the time taken to complete bank reconciliations, indicating the efficiency of the process and identifying areas for improvement.

- Number of Reconciliations with Errors:Highlights the frequency of errors in bank reconciliations, enabling businesses to address root causes and improve accuracy.

Identifying Trends and Areas for Improvement

By analyzing bank reconciliation data over time, businesses can identify trends and areas for improvement. For instance, recurring discrepancies between bank statements and internal records may indicate weaknesses in internal controls or data entry processes. High DSO values could signal issues with customer payment terms or billing practices.

By identifying such trends, businesses can take proactive measures to address underlying problems and enhance financial operations.

Detailed FAQs

What are the unique challenges of bank reconciliation in a healthcare setting?

Healthcare providers face complexities such as patient payments, insurance reimbursements, and varying transaction types, which can impact bank reconciliation accuracy.

How can Del Gato Clinic improve the timeliness of its bank reconciliation process?

By establishing clear timelines, automating tasks, and leveraging technology, Del Gato Clinic can streamline its reconciliation process, ensuring timely completion.

Why is documentation crucial for bank reconciliation?

Documentation provides a clear audit trail, supports adjustments, and ensures compliance with regulatory requirements.